Our Portfolio: A Showcase of Strategic Wins

On this page, we highlight some of our notable triumphs, each representing a careful blend of foresight, disciplined research, and prudent decision-making aligned with the principles of value investing.

01

In 2016, we made a strategic investment in Uranium Energy (Ticker: UEC) at USD 1 per share, and today, we're reaping the rewards as we sell at USD 7.50 per share, marking an outstanding gain of +650%.

About Uranium Energy (UEC):

Uranium Energy Corp. is a U.S.-based uranium mining and exploration company with a focus on leveraging the rising demand for clean and sustainable energy. The company is actively engaged in the exploration, development, and production of uranium properties in the United States.

Uranium, a critical component in nuclear power generation, has seen increased attention as nations worldwide strive to diversify their energy mix and reduce carbon emissions. Uranium Energy has positioned itself strategically in this sector, and our investment has not only capitalized on market trends but also contributed significantly to the overall success of the Beaver Funds portfolio.

02

In 2015, Beaver Funds made a strategic investment in CSW Industrials (Ticker: CSWI) at USD 30 per share. At the time of writing, as it stands at USD 215, the investment has yielded a remarkable +616% gain, solidifying CSWI's enduring presence in our global portfolio.

About CSW Industrials (CSWI):

CSW Industrials is a diversified industrial growth company with a focus on providing innovative solutions and high-performance products across various sectors. The company's commitment to excellence, coupled with its resilience in navigating market dynamics, has positioned CSWI as a key player in the industrial landscape.

Ongoing Presence and Undervaluation:

CSW Industrials continues to be a stalwart presence in the Beaver Funds portfolio, underscoring our conviction in its long-term potential. Despite its impressive performance, we believe CSWI remains undervalued, presenting an ongoing opportunity for our investors.

In 2006, Beaver Funds embarked on a journey of sound investment principles with the purchase of Berkshire Hathaway (Ticker: BRK.B) at USD 60 per share. Fast forward to today, with the stock standing at USD 386 at the time of writing, the investment has surged with a commendable +543% gain, solidifying Berkshire Hathaway's enduring position in our North America portfolio.

About Berkshire Hathaway (BRK.B):

Berkshire Hathaway, led by the legendary Warren Buffett, stands as a conglomerate synonymous with enduring value, sound management, and strategic investments across various industries. The company's diversified portfolio and long-term investment philosophy have made it an iconic entity in the financial landscape. The initial investment in Berkshire Hathaway, spanning over a decade, has been a testament to the enduring principles of value investing.

Ongoing Presence and Undervaluation:

Berkshire Hathaway remains an integral part of the Beaver Funds portfolio, symbolizing our steadfast belief in its lasting potential. Despite its remarkable performance, we continue to view BRK.B as underappreciated and undervalued, offering a persistent opportunity for our investors.

03

04

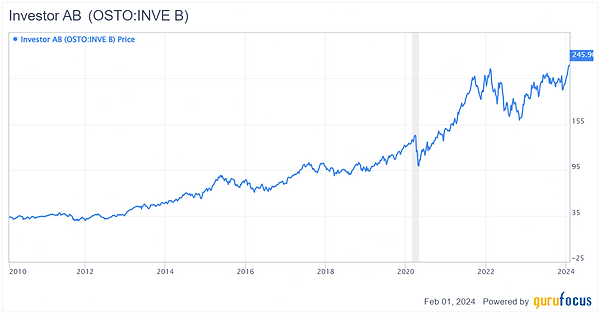

In 2010, Beaver Funds strategically acquired Investor AB (Ticker: INVE-B) at SEK 35 per share, setting the stage for a remarkable investment journey. Today, with the stock soaring to SEK 246 at the time of writing, the investment has witnessed an impressive +602% gain, firmly establishing Investor AB as a cornerstone asset in our European portfolio.

About Investor AB (INVE-B):

Investor AB, a prominent European investment company, operates with a focus on creating long-term value through active ownership and strategic investments. The company's commitment to sound financial principles and its influence across diverse industries make it a noteworthy entity within the European financial landscape.

Ongoing Presence and Undervaluation:

Investor AB continues to play a vital role in the Beaver Funds portfolio, underscoring our unwavering confidence in its enduring potential. Despite its remarkable performance, we maintain our view that INVE-B is undervalued, presenting a persistent opportunity for our investors within the European market.